Photo Credit: © 2012 Todd Shapera, Courtesy of PhotoShare

A version of this post originally appeared on Exchanges, the Contraceptive Technology Innovation Exchange blog. Reprinted with permission.

Listen to an interview with Markus Steiner and Kate Rademacher on the reductions in the prices of implant commodities.

Contraceptive implants have been available for over 30 years and are one of the most effective methods available. Until recently, however, international donors did not procure significant quantities, and use of the method in developing countries was very low. This access barrier was largely due to the high cost of implant commodities. The situation mirrored the classic, paradoxical question: which came first, the chicken or the egg? In this case, without lower commodity prices, procurements of implants would not increase in many international settings. But without higher volumes, manufacturers couldn’t lower their prices and still achieve a sustainable business model.

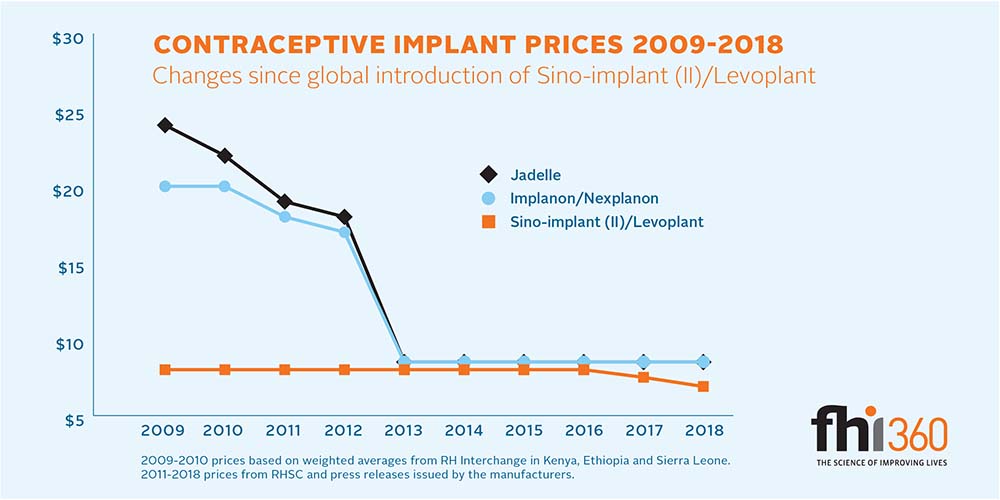

In the past few years, use of implants in sub-Saharan Africa has increased dramatically. Why have we seen this rapid change? Increased commitment on the part of governments and donors to expand access to long-acting methods, as well as changes in global policy and service delivery practices, has contributed to increased contraceptive prevalence and changes in countries’ method mix. Yet arguably, the biggest and most important change over the past decade has been reductions in the prices of implant commodities.

In 2007, Sino-implant (II) — a two-rod implant manufactured by Shanghai Dahua Pharmaceutical Co., Ltd (Dahua) in China now marketed globally as Levoplant — was one-third the price of the other implants on the market. Until 2009, however, the product was only registered in China and Indonesia. To make Sino-implant (II)/Levoplant more broadly available to women in developing countries and help increase access to affordable implants, the Bill & Melinda Gates Foundation funded a global initiative coordinated by FHI 360. This initiative achieved several key objectives:

- Levoplant was prequalified by the World Health Organization (WHO) in 2017. WHO prequalification is necessary for global procurement agencies (e.g., UNFPA and USAID) to distribute the product; it also facilitates registration at the country level.

- Leading up to WHO prequalification, a regulatory footprint and distribution platform was established in over 20 countries in collaboration with a variety of partners. Through this work, over one million units of the product were procured, resulting in over $10 million in commodity savings. Since Levoplant became WHO prequalified, UNFPA has procured nearly 500,000 units and USAID is taking steps to potentially procure the product in the near future.

- With the FHI 360-led initiative ending in late 2018, Dahua recently formed a partnership with DKT International to act as Dahua’s global distributor; it also announced a further price reduction of $6.90 for Levoplant in Family Planning 2020 (FP2020) countries.

Aside from these key outcomes, the most important legacy of Levoplant may be the catalytic role the product has played in bringing price competition to the market. As part of the broader Impact Access Program, the prices of Jadelle® and Implanon/Nexplanon® were reduced by Bayer Healthcare and Merck/MSD respectively to $8.50 per unit. Both manufacturers have committed to this price through 2023 in FP 2020 countries.

Commodity costs are only one part of the total cost necessary to scale up a method successfully. Yet when commodity costs are too high, all subsequent resources often cannot be marshalled to bring the product to scale. And, without achieving scale, manufacturing at low volumes often results in high commodity costs. Fortunately, with contraceptive implants, this chicken or egg dilemma has been addressed. Moving forward, we must now work together as a global community to achieve the same positive outcomes with other new and underused methods entering the global market.

This blog series is a collaboration with K4Health.